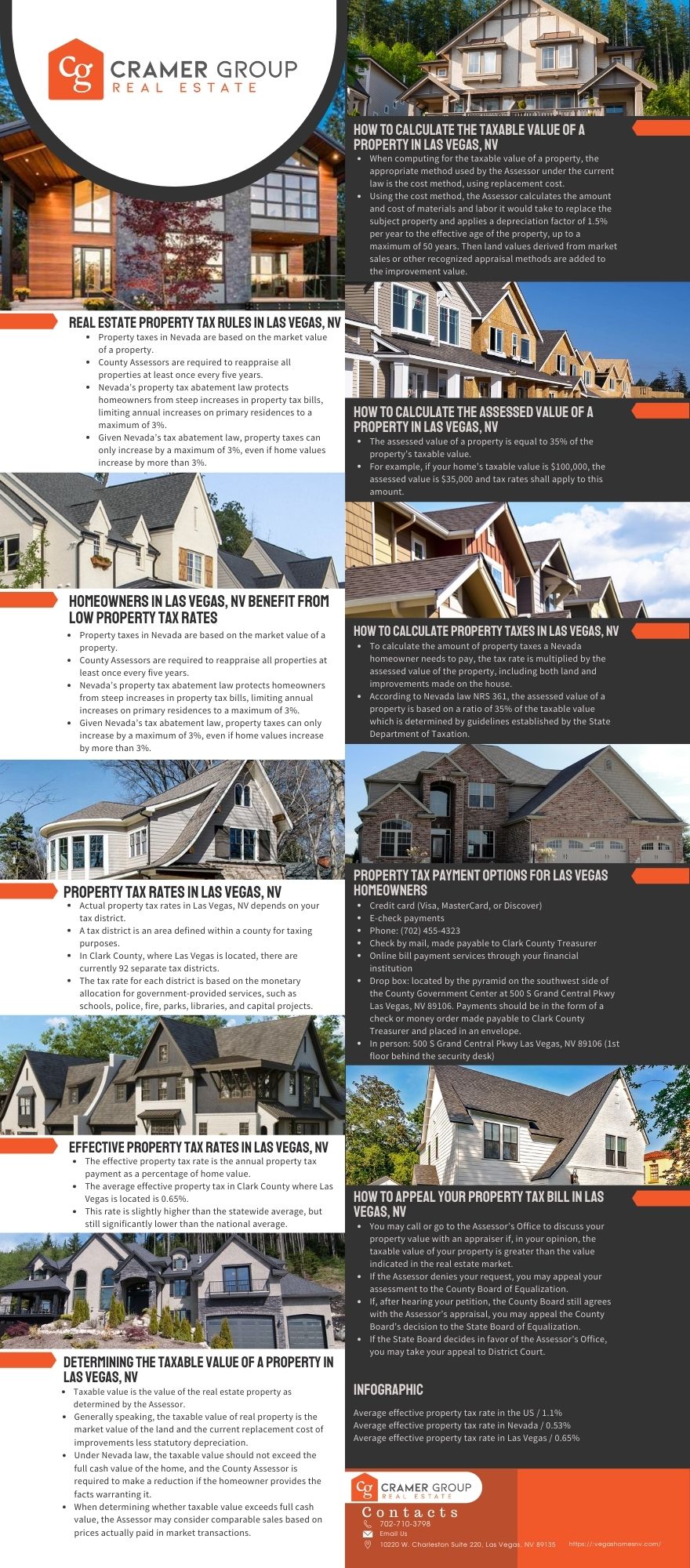

property tax las vegas nv

The amount of property taxes a homeowner pays is determined by multiplying the tax. See Property Records Tax Titles Owner Info More.

Nevada Tax Rates And Benefits Living In Nevada Saves Money

To ensure timely and accurate posting please write your parcel numbers on the check and.

. Clark County has one of the highest median property taxes in the United States and is ranked 546th of the 3143 counties in order of median property taxes. Future Due Dates Notice of Delinquent Taxes on Real Property NRS 361565 Facebook Twitter Instagram Youtube NextDoor. Las Vegas NV 89155-1220.

Ad Search County Records in Your State to Find the Property Tax on Any Address. However earning less than 100000 in non-property income means you can deduct up to 25000 of any losses your rental property. Las Vegas NV 89106.

795000 Last Sold Price. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300. Make Real Property Tax Payments.

Office of the County Treasurer. Land and land improvements are considered real property while mobile property is classified as personal property. The property tax rates in Nevada are some of the lowest in the nation.

Clark County contains almost 75 of the states residents and includes Las Vegas. House Arrest Electronic Monitoring Program. Treasurer - Real Property Taxes.

SOLD MAR 18 2022. Real Property Tax Due Dates. City of Henderson Property.

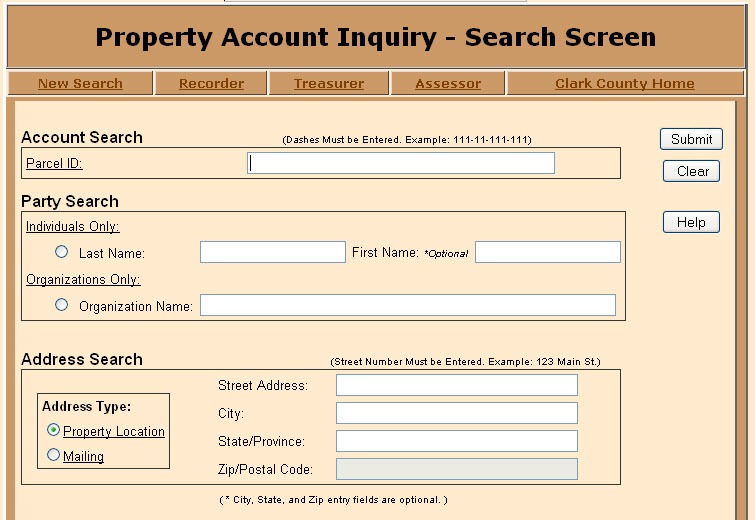

There are currently 3412 red-hot tax lien listings in Las Vegas NV. Property Account Inquiry - Search Screen. Doing Business with Clark County.

Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. Our Rule of Thumb for Las Vegas sales tax is 875. Enter an Address to Receive a Complete Property Report with Tax Assessments More.

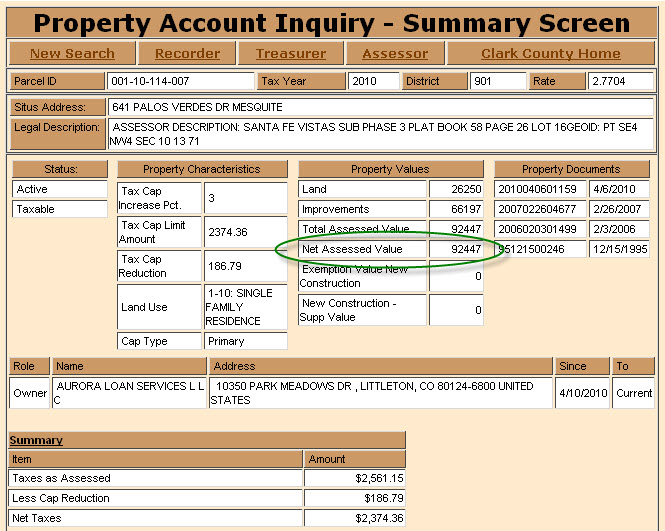

Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be 35000. To qualify the Veteran must have an honorable separation from the service and be a resident of Nevada. Grand Central Pkwy Las Vegas.

There are numerous tax districts within every Nevada county. In addition Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes. The average effective property tax rate in Nevada is 053 while the national average is 107.

Search Homes Our Team Our Agents Las Vegas Communities Housing Information Blog Contact Search Homes Our Team Our Agents Las Vegas Communities. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. The amount of exemption is dependent upon the degree of disability incurred.

Las Vegas NV 89155 702. Account Search Dashes Must be Entered. As a general rule of thumb annual estimated property taxes can be calculated at roughly 5-75 of the purchase price.

Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. The surviving spouse of a disabled. 702 455-4323 Fax 702 455-5969.

NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Each districts tax rate is determined by the money allocated to government-provided services including. The assessed value is equal to 35 of the taxable value.

American Rescue Plan Act. Technically the Las Vegas sales tax rate is between 8375 and 875. 111-11-111-111 Address Search Street Number Must be Entered.

There are currently 92 distinct tax districts in Clark County where Las Vegas is located. Assessor - Personal Property Taxes. Additionally the City of Las Vegas charges 05 city sales tax the City of Henderson also charges their sales tax percentage.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. So a home valued at 500000 has a fiscal year property tax of 577535. The low rate on property taxes is one of the main.

Payment Options for Real Property Taxes only Mail. A tax district is an area within a county-designated for taxation purposes. Property Tax Rates for Nevada Local Governments Redbook.

Las Vegas NV 89106. The State of Nevada sales tax rate is 46 added to the Clark County rate of 3775 equals 8375. Tax amount varies by county.

Treasurer - Real Property Taxes. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Lets make an example to see this Las Vegas property tax calculated in real time for a home valued at 500000.

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. In Las Vegas NV the estimated annual property taxes can be calculated at roughly 5 to 75 of the home purchase price. Find My Commission District.

Clark County for example lists 92 different tax districts with different rates for each district. 123 Main St City State and Zip entry fields are optional. Las Vegas Nevada 89155-1220.

Las Vegas NV 89106. Clark County Detention Center Inmate Accounts. Facebook Twitter Instagram Youtube NextDoor.

A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada. Apply for a Business License. Apply for a.

Your tax district determines your property tax rate in Las Vegas NV. Nevada Property Tax Rates. The Assessor parcel maps are for assessment use only and do NOT represent a survey.

The assessed values are subject to change before being finalized for ad valorem tax purposes. Tax rates apply to that amount. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy.

Clark County collects on average 072 of a propertys assessed fair market value as property tax. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. SOLD MAR 3 2022.

Tax bills requested through the automated system are sent to the mailing address on record. Treasurer - Real Property Taxes. Nearby homes similar to 5291 Harrison Dr have recently sold between 360K to 950K at an average of 240 per square foot.

Enjoy the pride of homeownership for less than it costs to rent before its too late. Las Vegas NV 89155 Phone 702455-3882. Checks for real property tax payments should be made payable to Clark County Treasurer.

The assessment ratio is 35 and the tax rate in Las Vegas is 33002 per hundred dollars of assessed value. This public search page can be used to determine current property taxes for any property in Las Vegas and Henderson. Public Property Records provide information on land homes and commercial properties in Las Vegas including titles property deeds mortgages property tax assessment records and other documents.

Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60. In 2007 not long before Las Vegas frenzied real estate market imploded Nevada lawmakers approved a seemingly minor tweak to a tax lawThe change ensured p. Make Personal Property Tax Payments.

Nevada is ranked number twenty four out of the fifty states in order. Its use or its interpretation. American Rescue Plan Act.

Search Any Address 2. The average effective property tax in the county is 065 slightly. Las Vegas NV 89155-1220.

084 of home value. About Assessor and Property Tax Records in Nevada Nevada real and personal property tax records are managed by the County Assessor in each county. If your propertys expenses are larger than the Schedule E rental income you accrued you can deduct any losses from your taxable income if your non-property based income is less than 150000 in the tax year.

1625 Santa Anita Dr Las Vegas NV 89119. Grand Central Pkwy Las Vegas NV 89155.

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Living In Las Vegas Nv Pros And Cons Of Moving To Las Vegas 2022 Retirebetternow Com

Top 10 Reasons To You Should Move To Las Vegas Nv

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Taxpayer Information Henderson Nv

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Mesquitegroup Com Nevada Property Tax

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Nevada Vs California Taxes Explained Retirebetternow Com

Mesquitegroup Com Nevada Property Tax

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

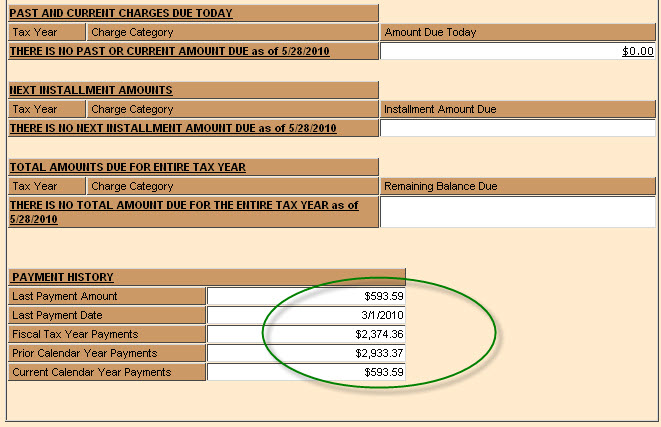

Las Vegas Area Clark County Nevada Property Tax Information

Mesquitegroup Com Nevada Property Tax

Taxpayer Information Henderson Nv

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

What S The Property Tax Outlook In Las Vegas Mansion Global

Nevada Is The 9 State With The Lowest Property Taxes Stacker